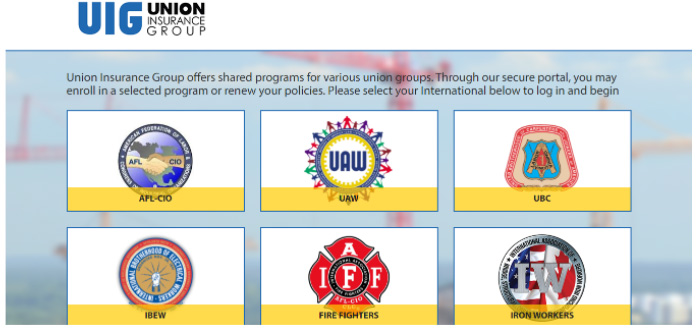

Union Insurance Group – UIG

UIG – Custom Web Application

Client Profile

Union Insurance Group, with more than 6,800 labor organizations onboard ranging from small, locals to internationals, is the largest agency specializing in business insurance, protection, and peace of mind for labor organizations.

Client Industry

Insurance

Business Challenges

In a technology-driven market, UIG had several challenges with their data and insufficient database modules. UIG required a user-friendly and dynamic web application to manage their eCommerce, automate the traditional manual procedure and integrate a strong, reliable, and secure payment system.

Other complexities entailed:

- Document Control

The paper procurement procedure had to be carefully regulated and maintained in order for the company’s storage policies not only to meet but exceed client expectations. - Error Handling

The lack of error handling in the system made the procurement process long-delayed and error-prone. - Duplication or Data Redundancy

Insufficient tools for validating and eradicating repetitive data. - Process Delay

The time spent on multiple departmental dependencies delayed and affected the procurement process. - Cost Overrun

The cost and number of working hours increased as more time was devoted to manual tasks. - Readability Concerns

As the number of bills and invoices grew, so did UIG’s workload. They were manually monitoring each stage for payments with no automation in place to help them out.

Solution

Plego automated UIG’s challenges by developing a powerful web application to store essential data regarding clients’ insurance with secure and personalized payment integration modules for seamless transactions.

Plego automated their data collection process, earlier held within spreadsheets, to increase accuracy and provide access to more precise data, allowing firm executives to make better decisions.

UIG also benefited from other features such as;

- All information of authorized parties is integrated into a single platform.

- The web portal envisioned a paperless environment to save processing time.

- Improved insights into UIG’s clients, processing, and payment modules to offer a more comprehensive picture.

- A customized integrated payment system for clients to purchase SUL or LOB Policies online and offline for their employees.

- An innovative, dynamic and responsive system to help UIG produce more accurate projections while tracking and monitoring each asset and resource of future business needs and revenues in this technologically advanced age.

- Two web portals, each for the Policy owner and Admin of UIG, with ultra-modern, automated, and user-friendly interfaces.

The Admin Features Are as Follows:

Home

Main Interface briefly highlights the Information about the beneficiaries of UIG.

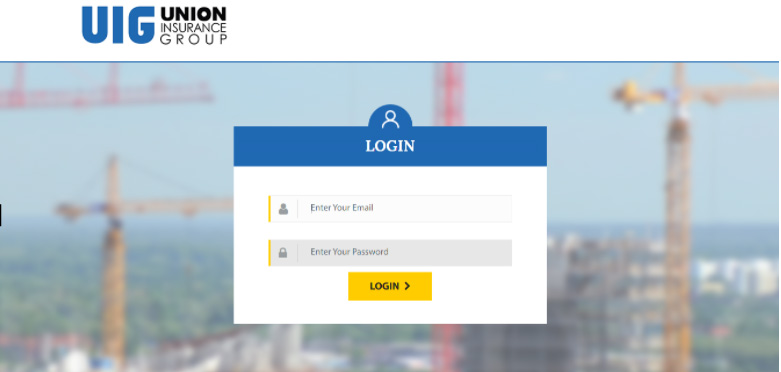

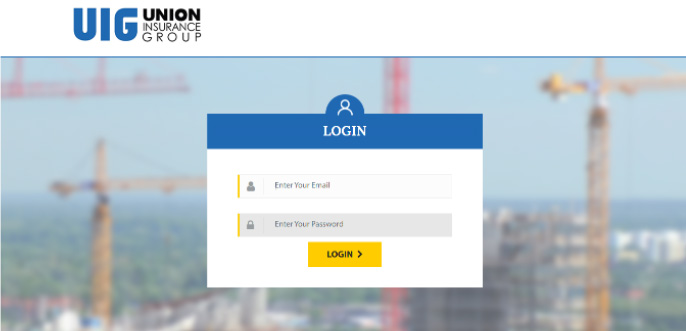

Login

Admin needs to apply the credentials to have complete access.

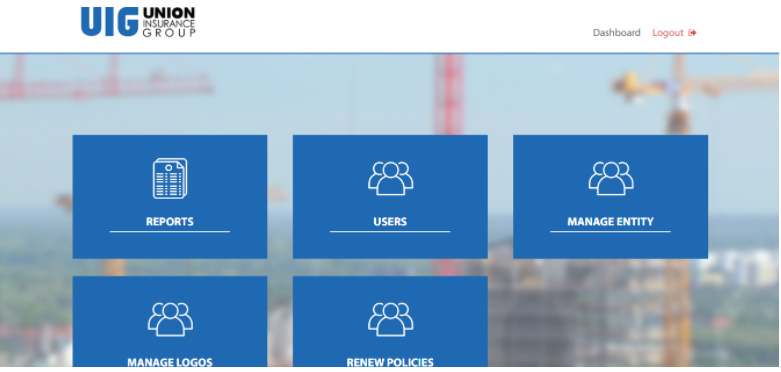

Dashboard

The Main Interface of the Dashboard displays all the essential categories with thumbnail internal links embedded such as;

- Reports.

- Users.

- Manage Entity.

- Manage Logos.

- Renew Policies.

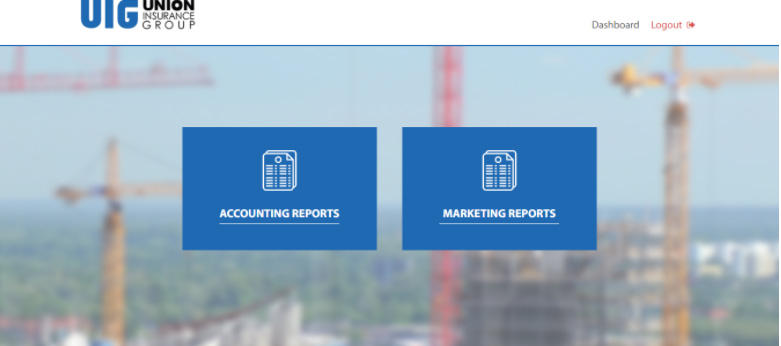

Reports

This section is divided into two categories;

- Accounting Reports.

- Marketing Reports.

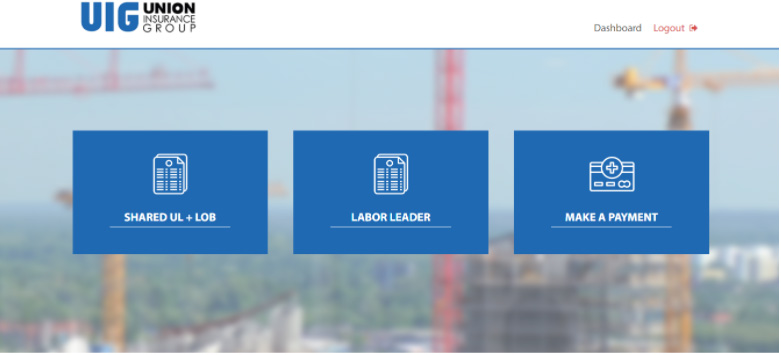

Accounting Reports

This interface of accounting reports is further divided into three categories;

- Types of Policies such as SUL + LOB.

- Labor Leader.

- Make a Payment.

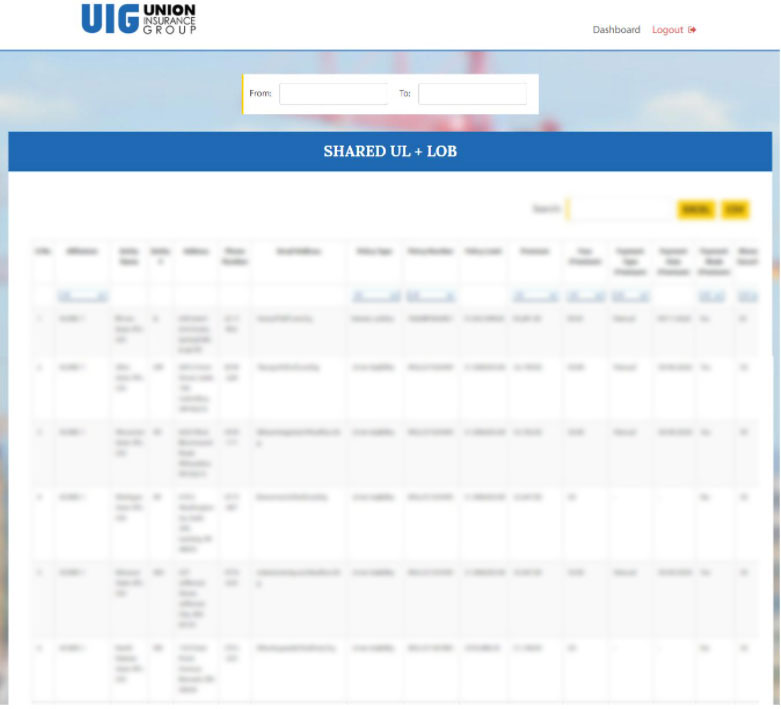

Shared UL + LOB

SUL and LOB are types of policies clients want for the employees.

- Shared UL: A section where a client purchases multiple policies for the employees at once.

- LOB: A section where a client purchases a policy, whenever the necessity arises.

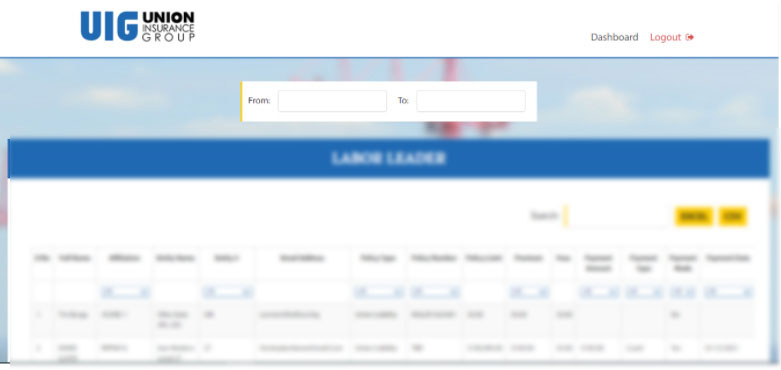

The detailed report stores all the data of policies acquired by the clients against their employees for both the types “SUL” and “LOB”. Other detail includes;

- Text Fields From – To (Dates).

- Search Bar.

- Excel sheet (Downloadable).

Further, all the essential details regarding policies are fetched and recorded in form of rows and columns.

- Such Important columns are;

- Affiliation Type.

- Entity / Client Name.

- Phone Number and Address.

- Email Address.

- Policy Type.

- Policy Limit (Include range).

- Premium (Total Amount).

- Fees (On Premium).

- Payment Type (Manual or Online).

- Payment Date.

- Payment Made (Status).

- Money Security (Extra Deposited Money).

Labor Leader

This Section covers LOB. All the essential features are the same as conferred earlier

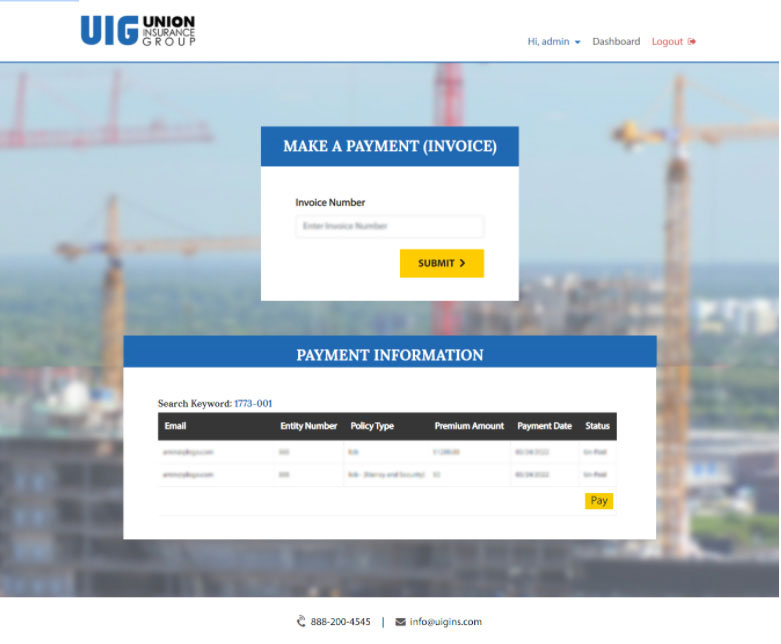

Make A Payment

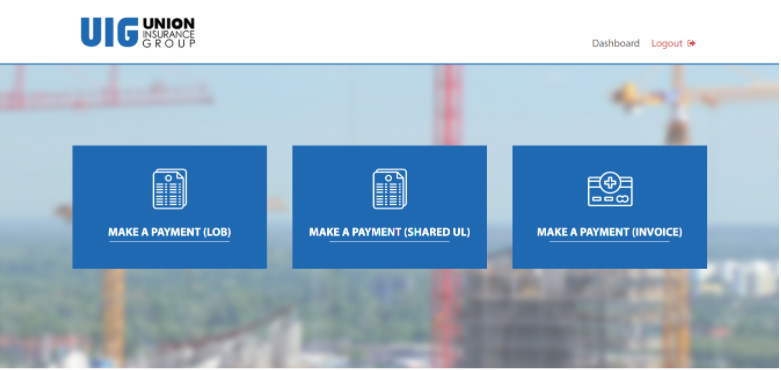

This customized interface displays further three modules.

These models provide access to the admin to pay on behalf of the client, namely;

- Make a Payment (LOB).

- Make a Payment (SUL).

- Make a Payment (Invoice).

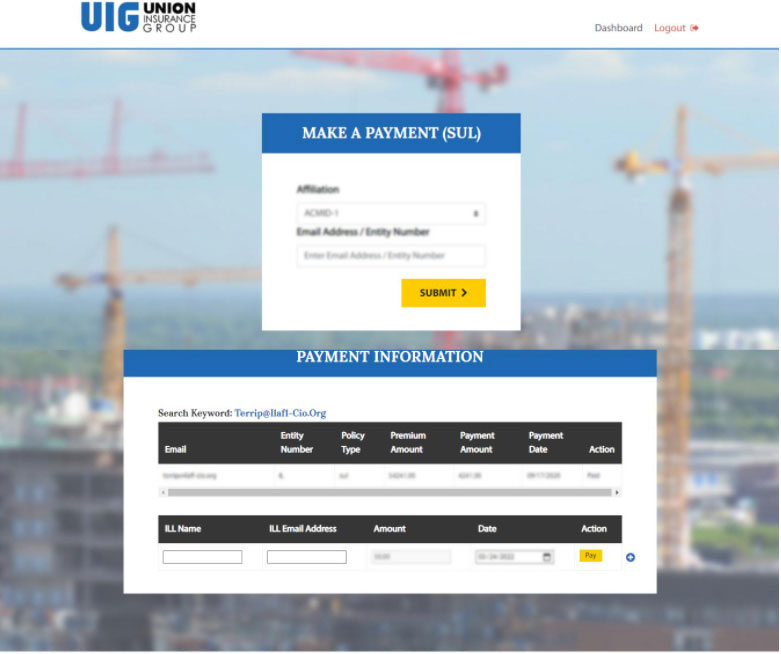

Make A Payment LOB And SUL

Upon a click on any of the above categories of SUL or LOB, A form appears with almost the same text fields such as;

- Affiliation (Type).

- Email Address / Entity number of the client whose payment is being made.

- “Pay” button redirects admin to PayPal or other payment methods – (Screen capture attached for reference).

Make A Payment (Invoice)

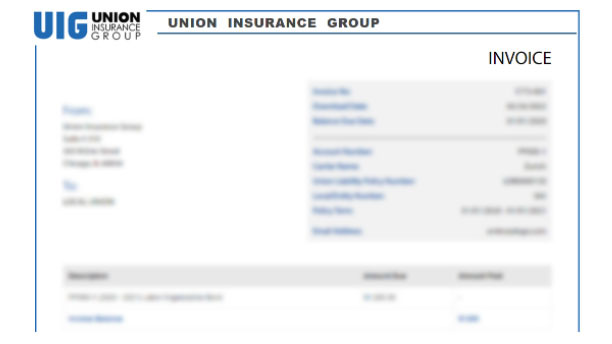

This Section helps the admin pay the dues (If so) offline through Invoices. For that Admin needs to put an invoice number.

“Submit” button allows an admin to download the invoice.

Invoice

It enables Admin to download the Invoice and pay offline.

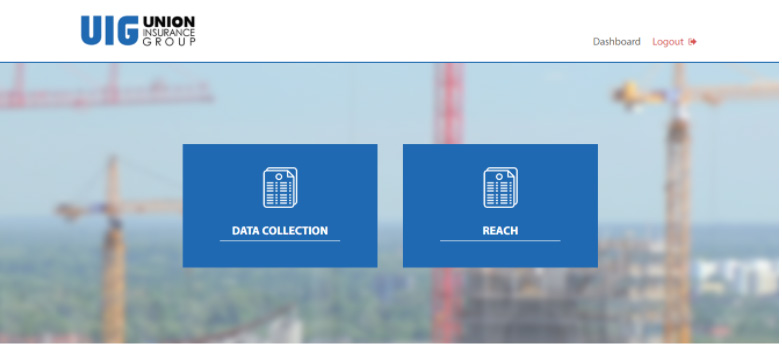

Marketing Reports

The interface of this Section displays two categories;

- Data Collection.

- Reach.

Data Collection

The volume of information is collected on-board and off-board from clients and forwarded to this section for marketing purposes.

Reach

The Web Application calculates and automates data to generate an analytical report that improves forecasting and decision-making techniques.

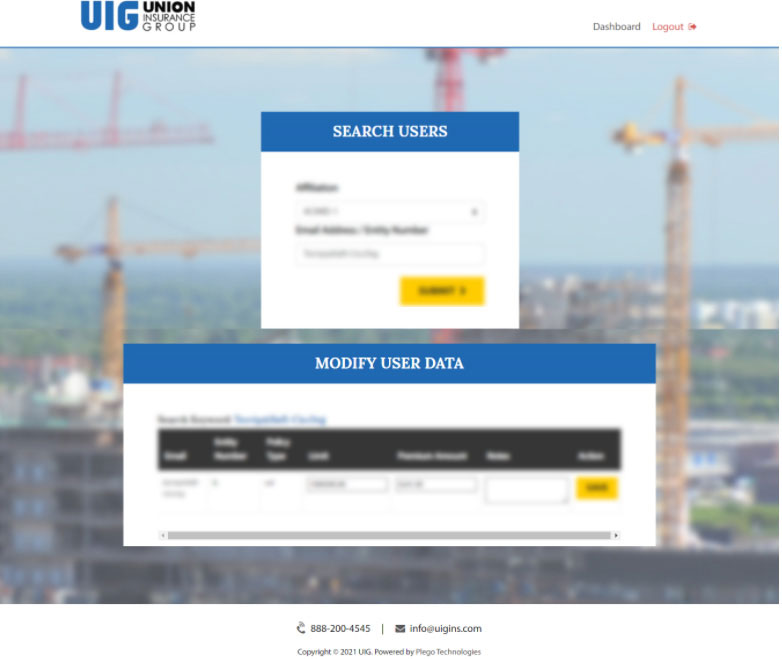

Users

- This section is dedicated for the admin to observe the performance of clients in terms of Policies and payment against them.

- Admin can search for Policy Owners by entering their affiliation and email address in the search box (Sample).

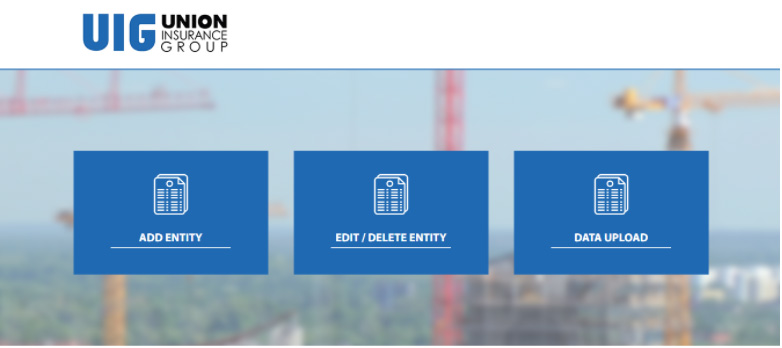

Manage Entity

This interface is divided into three sections, each of which allows the administrator to Include and Modify the Policy beneficiaries from the UIG domain. Such as;

- Add Entity.

- Edit Entity.

- Data Upload.

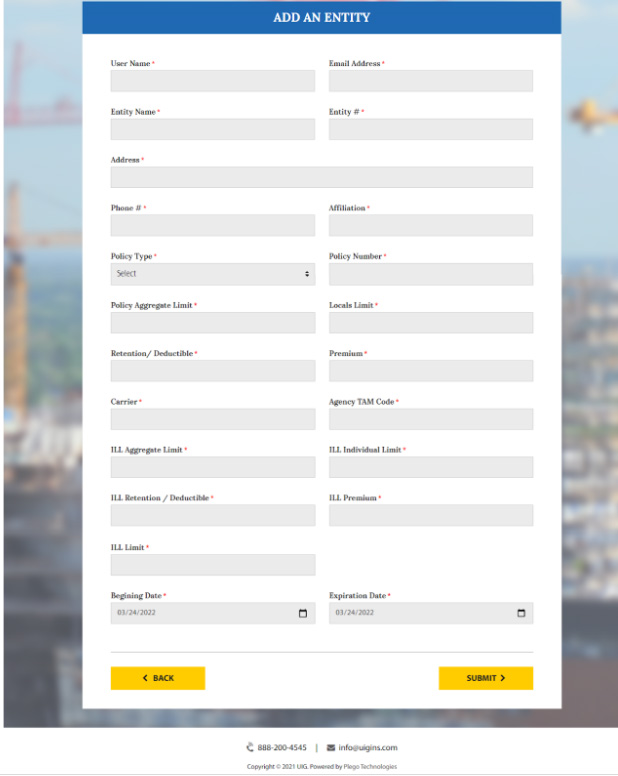

Add Entity

This section allows the admin to add all the detail of the new client with detail from;

- Entity name to the Policy type.

- Limit to the Premium Amount.

- Start and expiry date.

Modify Entity

This Section enables the admin to edit the existing information of the policy owner.

Upload Data

This section helps Admin to Incorporate bulk data from the specific format of spreadsheets.

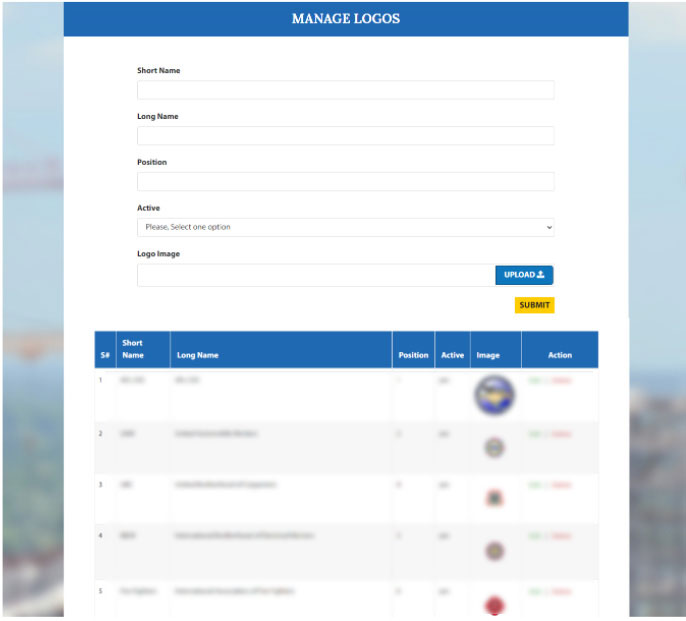

Manage Logos

The admin can analyze, manage, and upload the policy owners’ logos, sequence, status, and mandatory information using a user-friendly and dynamic interface.

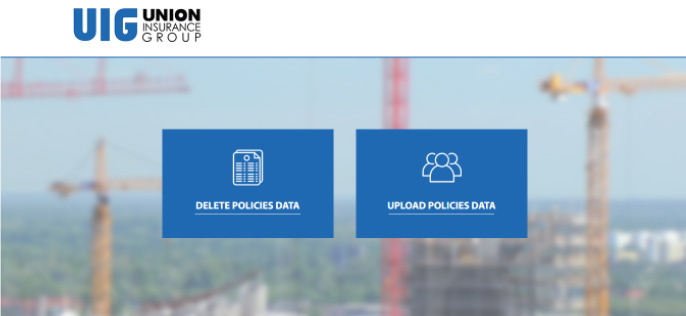

Renew Policies

This Interface displays two categories where the admin has access to delete, upload and overwrite the data of UIG’s Policies.

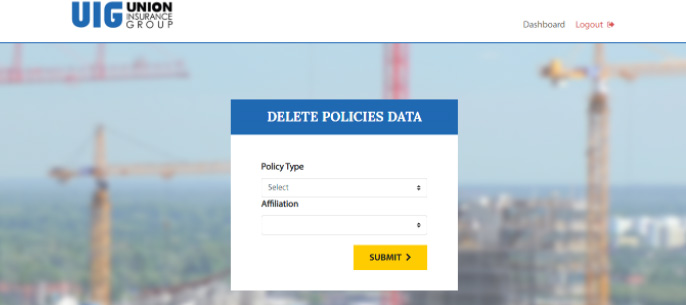

Delete Policies Data

To Delete the existing policy, Admin needs to select the “Policy Type” and the “Affiliation”. After adding the desired details, a “Submit” Button removes the policy from an entire platform of UIG.

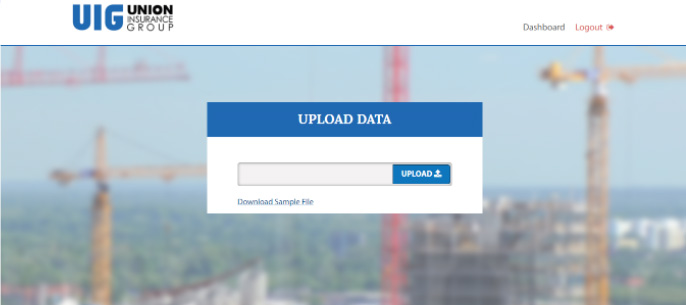

Upload Data

This Section enables the admin to upload the data (Stored in a spreadsheet format) that further reflects in designed tables inside reports.

The Policy Owner/User Features Are as Follows:

Login

Policy Owners need to apply the credentials to have complete access.

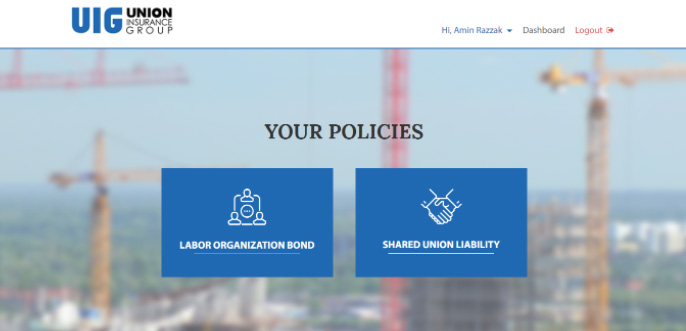

Your Policies

This interface reflects the policies that the users hold. Such as;

- Labor Organization Bond.

- Shared Union Liability.

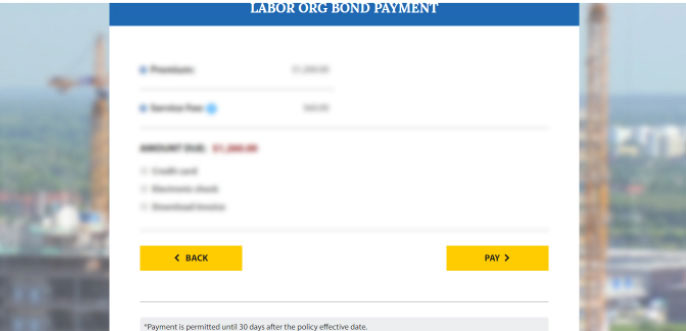

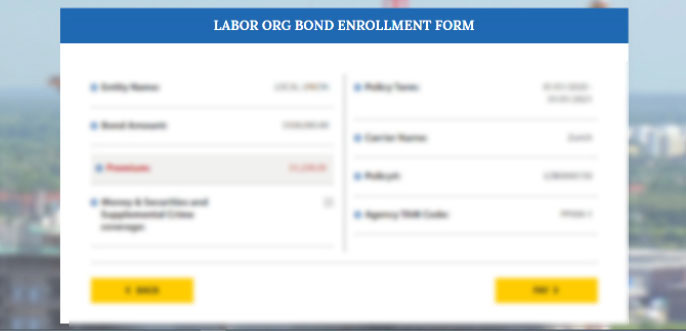

Labor Organization Bond

The enrolment form reflects the Client’s Information ranging from;

- An entity to the policy name.

- Policy amount to the premium, a customer holds.

A “Pay” button redirects the user to the payment method to clear the dues or deposit extra money in the wallet.

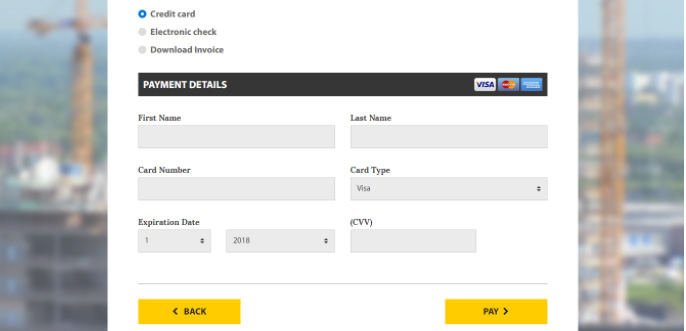

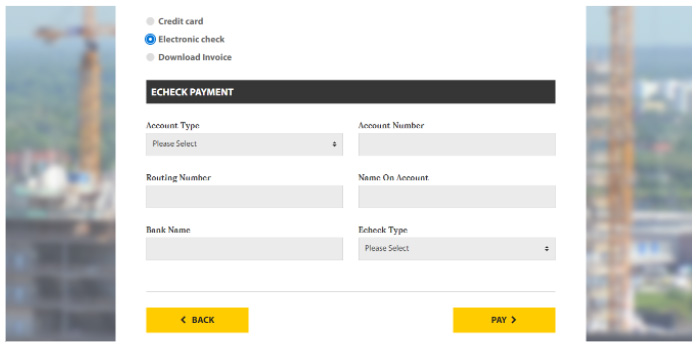

A Click on a “Pay” button takes a user to the integrated payment method to pay the due amount through following ways;

- Credit Card.

- Electronic Check.

- Invoice (Downloadable) to pay the amount in person

- The user needs to apply the credentials of a Credit Card to process the Payment.

- The facility of Electronic check processing is also available.

- Users can download the Invoice and pay offline.

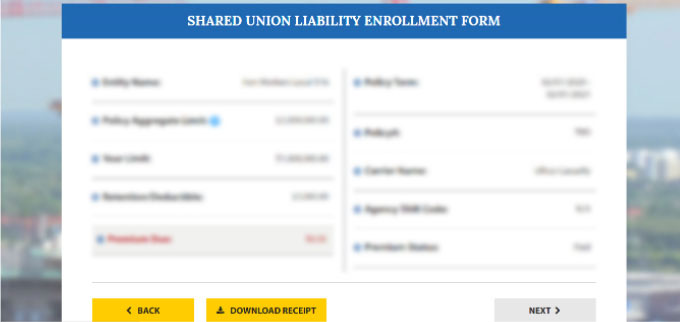

Shared Union Liability

This section includes all of the above-noted features.

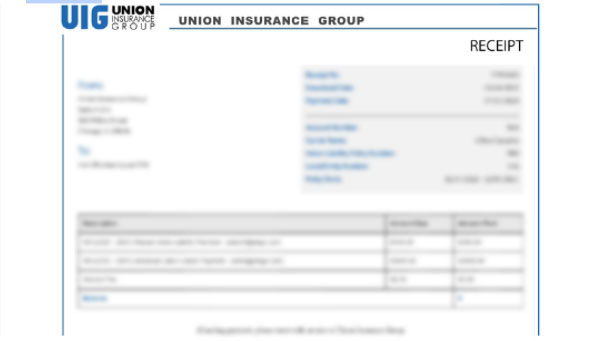

Download Receipt

This Electronic Receipt contains all the information of the client as a source of evidence such as;

- Account Number.

- Description.

- Amount Due.

- Amount Paid.

- Balance.

Technologies Used

PHP, MySQL,WordPress, JQuery, JavaScript

Services Provided

Application Development Services